为什么印度需要从日本借款4.74亿美元来建设班加罗尔地铁?我们难道没有足够的资金自己建设吗?-ag九游会j9登录入口旧版

why does india need $474 million loan from japan to build the metro in bengaluru? don''t we have the money to build it ourselves or something?译文简介

为什么印度需要从日本借款4.74亿美元来建设班加罗尔地铁?我们难道没有足够的资金自己建设吗?

正文翻译

kanthaswamy balasubramaniam

oh you are mistaken

you think india is going to japan for a loan?

its the other way round - japan is coming to india and requesting india for the chance to finance some projects

banks in japan are flush with cash. until 2018 they poured money into china but now china is flush with its own money and prefers to invest its own money.

japan needs investments. unlike the bullet train , the metro is a safe and solid investment.

so japan is the one who is requesting india for the loans and india has agreed to borrow from japan for both bangalore and delhi.

so we are the ones doing the favor here.

哦,你理解错了。你认为印度是向日本借贷款吗?实际情况是相反的——日本要来印度,并请求印度给予融资机会。日本的银行资金充裕。在2018年之前,他们将资金投入中国,但现在中国自己拥有充裕的资金,更愿意用自己的资金进行投资。日本需要投资。与高铁不同,地铁是安全可靠的投资。因此,日本是请求印度提供贷款的一方,而印度已同意从日本借款用于班加罗尔和德里的地铁建设。所以在这里是我们在帮助日本。

digesh chheda

japanese gives loan for 0.5–2% p.a. it will be very feasible for india to take those japanese money with both hands and use for our infra projects.

we can invest our money elsewhere which gives us high returns.

日本提供的贷款利率为每年0.5-2%。对于印度来说,以这样的利率接受日本的资金支持并将其用于基础设施项目非常可行。我们可以将自己的资金投资于其他能够带来高回报的领域上。

japanese gives loan for 0.5–2% p.a. it will be very feasible for india to take those japanese money with both hands and use for our infra projects.

we can invest our money elsewhere which gives us high returns.

日本提供的贷款利率为每年0.5-2%。对于印度来说,以这样的利率接受日本的资金支持并将其用于基础设施项目非常可行。我们可以将自己的资金投资于其他能够带来高回报的领域上。

bipin kumar

1.these loans are for specific projects. you can’t divert it for another project wily nily.

2.they have specific sourcing clauses as in requiring the project to use japanese components. in other words, these jica loans are to ensure demand for japanese manufacturing. hence the low interest rates.

1.这些贷款是为了具体的项目而设立的,不能随意将其用于其他项目。

2.这些贷款有特定的采购条款,要求项目使用日本的组件。换句话说,这些jica(日本国际合作机构)贷款旨在确保对日本制造业的需求,因此利率较低。

1.these loans are for specific projects. you can’t divert it for another project wily nily.

2.they have specific sourcing clauses as in requiring the project to use japanese components. in other words, these jica loans are to ensure demand for japanese manufacturing. hence the low interest rates.

1.这些贷款是为了具体的项目而设立的,不能随意将其用于其他项目。

2.这些贷款有特定的采购条款,要求项目使用日本的组件。换句话说,这些jica(日本国际合作机构)贷款旨在确保对日本制造业的需求,因此利率较低。

vishwanath kavalu shivadas

the initial funding for bmrcl was also done by jica, but you will not find that all the sourcing is done from japan, for example the rolling stock is from south korea and all the civil contractors are from india.

bmrcl(班加罗尔地铁铁路公司)的最初资金也是由jica提供的,但你会发现并非所有的采购都来自日本,例如动车组是来自韩国,而所有的土建承包商均来自印度。

the initial funding for bmrcl was also done by jica, but you will not find that all the sourcing is done from japan, for example the rolling stock is from south korea and all the civil contractors are from india.

bmrcl(班加罗尔地铁铁路公司)的最初资金也是由jica提供的,但你会发现并非所有的采购都来自日本,例如动车组是来自韩国,而所有的土建承包商均来自印度。

tony singh

also, just like any investment, even if you have the money, you shouldn't dump it all in if you can help it. financing can be useful and often is, more than paying out of pocket.

与任何投资一样,即使你有足够的资金,也不应该一次性全部投入。融资可以是有用的,通常比自掏腰包更好。

also, just like any investment, even if you have the money, you shouldn't dump it all in if you can help it. financing can be useful and often is, more than paying out of pocket.

与任何投资一样,即使你有足够的资金,也不应该一次性全部投入。融资可以是有用的,通常比自掏腰包更好。

sanjay vedachalam

i have a better solution like tell the japanese or chinese to build whatever they want and collect toll from it to recoup their investment if it goes into drain that's their fault and if it's profitable it could be taxed its win win situation

我有一个更好的ag九游会j9登录入口旧版的解决方案,就是告诉日本人或中国人建造任何他们想要的,并从中收取通行费以收回他们的投资,如果投资失败那是他们的责任,如果盈利还可以对其征税,这是双赢的情况。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

i have a better solution like tell the japanese or chinese to build whatever they want and collect toll from it to recoup their investment if it goes into drain that's their fault and if it's profitable it could be taxed its win win situation

我有一个更好的ag九游会j9登录入口旧版的解决方案,就是告诉日本人或中国人建造任何他们想要的,并从中收取通行费以收回他们的投资,如果投资失败那是他们的责任,如果盈利还可以对其征税,这是双赢的情况。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

norbu m ashraf

is not japan doing the favor by giving loans for a small amount? it is not my real point.

a business deal doesn’t have a favoring point at all. it is win-win and it is not that one favoring the other.

日本提供少量贷款并不是在帮我们的忙,这并不是我的真正观点。商业交易没有倾向一方的好处,它是双赢的,没有一方对另一方有利。

is not japan doing the favor by giving loans for a small amount? it is not my real point.

a business deal doesn’t have a favoring point at all. it is win-win and it is not that one favoring the other.

日本提供少量贷款并不是在帮我们的忙,这并不是我的真正观点。商业交易没有倾向一方的好处,它是双赢的,没有一方对另一方有利。

human species 10.0

every answer of u leaks of psedopatriotism. did you even read your answer after posting it. what u r saying is if we take loan from banks, then we are helping banks? and how exactly did we help japan when we were not flush with cash to even fund our own transportation idiot. such an idiocracy. if you don't know how to answer, just shut up. no need to highlight our country for its poor state.

你每个回答都透露着伪爱国主义的味道。你在发表回答之后有没有读过它?你所说的是,如果我们从银行借贷,那么我们就在帮助银行?而当我们自己的交通运输连资金都不充裕时,我们如何帮助日本呢,白痴。多么愚蠢的想法。如果你不知道如何回答,就闭嘴。没必要突出我们国家的困境。

every answer of u leaks of psedopatriotism. did you even read your answer after posting it. what u r saying is if we take loan from banks, then we are helping banks? and how exactly did we help japan when we were not flush with cash to even fund our own transportation idiot. such an idiocracy. if you don't know how to answer, just shut up. no need to highlight our country for its poor state.

你每个回答都透露着伪爱国主义的味道。你在发表回答之后有没有读过它?你所说的是,如果我们从银行借贷,那么我们就在帮助银行?而当我们自己的交通运输连资金都不充裕时,我们如何帮助日本呢,白痴。多么愚蠢的想法。如果你不知道如何回答,就闭嘴。没必要突出我们国家的困境。

hrushikesh avachat

i agree that india has nit done any favor to japan or vice-versa. it is a win-win deal. however, we need to understand that india has the capacity to complete the project without the help of external financing (by way of g-sec). the loans are taken from institutions like world bank or from countries like japan in order to save on the interest (rate of interest of jica is lower when compared to g-sec or indian banks)

我同意印度并没有对日本做出任何好处,反之亦然。这是一笔双赢的交易。然而,我们需要理解,印度有能力在没有外部融资的情况下完成该项目(通过政府证券)。贷款是从世界银行等机构或像日本这样的国家获得的,目的是为了节省利息(jica的利率相对于政府证券或印度银行较低)。

i agree that india has nit done any favor to japan or vice-versa. it is a win-win deal. however, we need to understand that india has the capacity to complete the project without the help of external financing (by way of g-sec). the loans are taken from institutions like world bank or from countries like japan in order to save on the interest (rate of interest of jica is lower when compared to g-sec or indian banks)

我同意印度并没有对日本做出任何好处,反之亦然。这是一笔双赢的交易。然而,我们需要理解,印度有能力在没有外部融资的情况下完成该项目(通过政府证券)。贷款是从世界银行等机构或像日本这样的国家获得的,目的是为了节省利息(jica的利率相对于政府证券或印度银行较低)。

sriram bhamidipati

the japanese have attained nirvana as per their religious philosophy and they don’t expect their principle back and are happy with the paltry interest

because,india has a proven track record of defaulting on it’s commitments and changing the rules abruptly by “retrospective” laws and what not.

and since japan has no problem with losing principle, they can invest into any unsafe territories, esp. india. so yes, they are doing themselves a great favor by investing (read, dumping) their money here

按照日本的宗教哲学,他们已经达到涅槃,他们并不期望拿回他们的本金,并对微薄的利息感到满意。因为印度在兑现承诺方面有着违约的过去记录,并通过“追溯法律”等方式突然改变规则。而且由于日本对失去本金没有问题,他们可以投资于任何不安全的地区,尤其是印度。所以,是的,他们通过在这里投资(也可以说是倾销)赐予自己很大的恩惠。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

the japanese have attained nirvana as per their religious philosophy and they don’t expect their principle back and are happy with the paltry interest

because,india has a proven track record of defaulting on it’s commitments and changing the rules abruptly by “retrospective” laws and what not.

and since japan has no problem with losing principle, they can invest into any unsafe territories, esp. india. so yes, they are doing themselves a great favor by investing (read, dumping) their money here

按照日本的宗教哲学,他们已经达到涅槃,他们并不期望拿回他们的本金,并对微薄的利息感到满意。因为印度在兑现承诺方面有着违约的过去记录,并通过“追溯法律”等方式突然改变规则。而且由于日本对失去本金没有问题,他们可以投资于任何不安全的地区,尤其是印度。所以,是的,他们通过在这里投资(也可以说是倾销)赐予自己很大的恩惠。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

harideep gowda

japan is facing deflation.

they have surplus money and are technologically advanced in public infrastructure.

japan is now giving loans to developing countries in the form of japan international cooperation agency funds (jica) in return they are expecting loan amount payback in less interest rates (around 1 to 1.15%) and longer duration also with a grace period. all the works under jica will bee compliance with guidelines for the employment of consultants under japanese oda loans.

japan is making income to its country by investing in the development projects of other countries.

india is not expecting any loan from japan but japan is investing in india for long-term returns.

日本正面临通缩问题。

他们有过剩的资金,并在公共基础设施方面处于技术先进的地位。

目前,日本以日本国际合作机构(jica)资金的形式向发展中国家提供贷款,作为回报,他们期望以较低的利率(约为1至1.15%)和较长的期限以及宽限期偿还贷款金额。所有在jica下进行的工作将符合日本oda贷款顾问就业指南。

日本通过投资其他国家的发展项目为自己的国家创造收入。

印度并不期望从日本获得任何贷款,但日本正在投资于印度以获得长期回报。

japan is facing deflation.

they have surplus money and are technologically advanced in public infrastructure.

japan is now giving loans to developing countries in the form of japan international cooperation agency funds (jica) in return they are expecting loan amount payback in less interest rates (around 1 to 1.15%) and longer duration also with a grace period. all the works under jica will bee compliance with guidelines for the employment of consultants under japanese oda loans.

japan is making income to its country by investing in the development projects of other countries.

india is not expecting any loan from japan but japan is investing in india for long-term returns.

日本正面临通缩问题。

他们有过剩的资金,并在公共基础设施方面处于技术先进的地位。

目前,日本以日本国际合作机构(jica)资金的形式向发展中国家提供贷款,作为回报,他们期望以较低的利率(约为1至1.15%)和较长的期限以及宽限期偿还贷款金额。所有在jica下进行的工作将符合日本oda贷款顾问就业指南。

日本通过投资其他国家的发展项目为自己的国家创造收入。

印度并不期望从日本获得任何贷款,但日本正在投资于印度以获得长期回报。

ritaban datta

you see taking a loan is an easier and a much much cheaper option than self financing, even if you have the capability to finance it yourself….

take yourself as an individual… suppose you have rs 1 lac with yourself… and you need rs 1 lac to meet some personal expenses say renovation of your house… now suppose your rs 1 lac is invested as a fd and is earning an interest of say 5.5%… and the market rate of a loan from the same bank in which you have an fd is 7%…

now you have 2 options… either to utilise your fd or keep it as it is and take a loan to finance renovation of your house… in the first case, you will lose the 5.5% interest that your money is earning in the form of fd… in the latter case, you land up paying an effective interest rate of 1.5% only… because to service the loan you will pay 7% per annum and at the same time your funds in the form of an fd is earning 5.5% roi per annum..

so, india taking a loan of the said amount from japan is pretty much welcomed as had the country financed it itself it would have lost the opportunity to invest the same amount elsewhere… by taking a loan the country ensures that the same amount can be invested in 2 productive avenues one of which is the metro and the other somewhere else which gets the country some form of tangible or intangible return over either the short or the long term…

你看,借贷比自筹资金更容易、更便宜,即使你有能力自行融资... 以个人为例...假设你手头有10万卢比...你需要10万卢比用于一些个人开支,比如房屋翻修...现在假设你的10万卢比作为定期存款存入银行,年利率为5.5%...而同一家银行的贷款市场利率为7%...

现在你有两个选择:要么利用你的定期存款,要么保持不变并且借贷来为房屋翻修提供资金。在第一种情况下,你将失去你的资金以定期存款形式所获得的5.5%利息。而在后一种情况下,你将支付实际利率为1.5%的利息。因为为了偿还贷款,你每年支付7%,与此同时,你的定期存款以5.5%的年回报率增值。

因此,印度从日本贷款是非常受欢迎的,因为如果该国自己融资,就会失去将相同金额投资在其他地方的机会。通过贷款,国家确保相同的金额可以在两个有产出的领域中投资,其中之一是地铁建设,另一个则是其他可以在短期或长期内给国家带来某种有形或无形回报的地方。

you see taking a loan is an easier and a much much cheaper option than self financing, even if you have the capability to finance it yourself….

take yourself as an individual… suppose you have rs 1 lac with yourself… and you need rs 1 lac to meet some personal expenses say renovation of your house… now suppose your rs 1 lac is invested as a fd and is earning an interest of say 5.5%… and the market rate of a loan from the same bank in which you have an fd is 7%…

now you have 2 options… either to utilise your fd or keep it as it is and take a loan to finance renovation of your house… in the first case, you will lose the 5.5% interest that your money is earning in the form of fd… in the latter case, you land up paying an effective interest rate of 1.5% only… because to service the loan you will pay 7% per annum and at the same time your funds in the form of an fd is earning 5.5% roi per annum..

so, india taking a loan of the said amount from japan is pretty much welcomed as had the country financed it itself it would have lost the opportunity to invest the same amount elsewhere… by taking a loan the country ensures that the same amount can be invested in 2 productive avenues one of which is the metro and the other somewhere else which gets the country some form of tangible or intangible return over either the short or the long term…

你看,借贷比自筹资金更容易、更便宜,即使你有能力自行融资... 以个人为例...假设你手头有10万卢比...你需要10万卢比用于一些个人开支,比如房屋翻修...现在假设你的10万卢比作为定期存款存入银行,年利率为5.5%...而同一家银行的贷款市场利率为7%...

现在你有两个选择:要么利用你的定期存款,要么保持不变并且借贷来为房屋翻修提供资金。在第一种情况下,你将失去你的资金以定期存款形式所获得的5.5%利息。而在后一种情况下,你将支付实际利率为1.5%的利息。因为为了偿还贷款,你每年支付7%,与此同时,你的定期存款以5.5%的年回报率增值。

因此,印度从日本贷款是非常受欢迎的,因为如果该国自己融资,就会失去将相同金额投资在其他地方的机会。通过贷款,国家确保相同的金额可以在两个有产出的领域中投资,其中之一是地铁建设,另一个则是其他可以在短期或长期内给国家带来某种有形或无形回报的地方。

ankur sengupta

“metro construction is insanely expensive!”

地铁建设成本非常昂贵!

“metro construction is insanely expensive!”

地铁建设成本非常昂贵!

the delhi metro can easily be labeled as the crown jewel of public transportation in india. but have you ever wondered about the cost and effort that goes behind establishing this swanky airconditioned transport system?

德里地铁可以轻易被称为印度公共交通的明珠。但你是否曾经想过,在建立这个豪华的空调交通系统背后所付出的成本和努力呢?

德里地铁可以轻易被称为印度公共交通的明珠。但你是否曾经想过,在建立这个豪华的空调交通系统背后所付出的成本和努力呢?

the metro construction cost the public exchequer an average of ₹210 crores per kilometer.

地铁建设平均每公里耗资21亿卢比。

地铁建设平均每公里耗资21亿卢比。

yes! you read that right. while the elevated stretches of the phase 3 expansion were completed at an average cost of ₹180-200 crores per kilometer, the amount spent on the underground stretch was more than double of that amount. construction on the third phase, began in 2011 and was expected to complete by 2016. however, the project is yet to be completed and the construction cost continues to escalate. once completed, phase 3 will stretch over 167 kilometers. assuming that the remainder of the project is completed at the same cost, the total expenditure on phase 3 by completion would be around ₹ 35,000 crores.

是的!你没看错。尽管第三阶段扩建的高架路段的平均建设成本为每公里18亿至20亿卢比,但地下路段的花费超过了这个数额的两倍以上。第三阶段的建设始于2011年,预计在2016年完成。然而,该项目仍未完工,施工成本持续上升。一旦完工,第三阶段将延伸167公里。假设剩余部分的项目以相同的成本完成,第三阶段的总支出将达到约3500亿卢比。

是的!你没看错。尽管第三阶段扩建的高架路段的平均建设成本为每公里18亿至20亿卢比,但地下路段的花费超过了这个数额的两倍以上。第三阶段的建设始于2011年,预计在2016年完成。然而,该项目仍未完工,施工成本持续上升。一旦完工,第三阶段将延伸167公里。假设剩余部分的项目以相同的成本完成,第三阶段的总支出将达到约3500亿卢比。

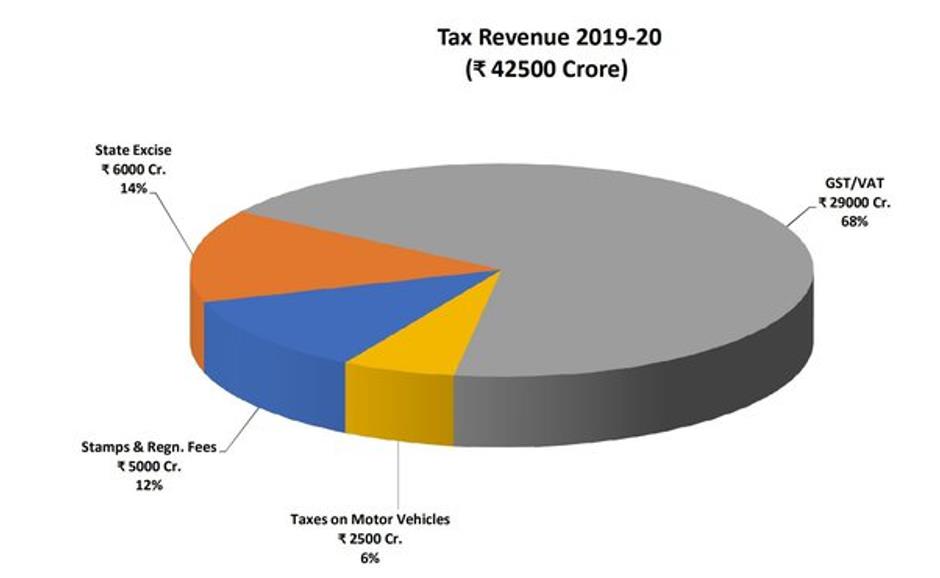

now consider the total tax collected by the delhi government in fy2019:

现在看一下德里政府在2019财年征收的总税收:

现在看一下德里政府在2019财年征收的总税收:

as you can clearly see, if india did not borrow money from japan at low interest rates (1~2%), construction would have gone on for much longer and the construction cost per kilometer would have increased in accordance. the loan offered by japan is quite cheap and helps us accelerate the construction. otherwise any impact on tax revenue would have further hampered the project.

正如您可以清楚地看到的,如果印度没有以低利率(1-2%)从日本借款,建设工程将会延长很多时间,并且每公里的建设成本将会相应增加。日本提供的贷款非常便宜,帮助我们加快了建设进度。否则,对税收收入的任何影响都将进一步妨碍项目的进行。

piyush raj

india may seek loans from other countries or international organizations to fund large infrastructure projects like the metro in bengaluru for several reasons, including:

1.insufficient domestic funds: india may not have sufficient domestic funds to finance large-scale infrastructure projects, such as the construction of a metro system.

2.attractive interest rates: loans from foreign countries or international organizations may offer more attractive interest rates compared to domestic loans, which may be subject to higher interest rates.

3.access to technology and expertise: by seeking loans from foreign countries or international organizations, india may also gain access to technology and expertise that can be helpful in building the metro system.

4.faster implementation: seeking loans from foreign countries or international organizations may help to expedite the implementation of the project by providing access to additional funds.

it is important to note that seeking loans from other countries or international organizations is a common practice for countries around the world, including developed nations. it is often seen as a way to finance large infrastructure projects that can contribute to economic growth and development.

印度可能会向其他国家或国际组织寻求贷款来资助像班加罗尔地铁这样的大型基础设施项目的原因包括:

1.国内资金不足:印度可能没有足够的国内资金来为大规模基础设施项目,如地铁系统的建设提供资金支持。

2.利率优势:与国内贷款相比,外国国家或国际组织的贷款可能提供更有吸引力的利率条件,其利率可能较低。

3.获取技术和专业知识:通过向外国国家或国际组织寻求贷款,印度还可以获得在建设地铁系统方面有帮助的技术和专业知识。

4.加快实施进度:从外国国家或国际组织寻求贷款可以通过提供额外资金来加速项目的实施进度。

需要注意的是,向其他国家或国际组织寻求贷款是世界各国(包括发达国家)的常见做法。这通常被视为一种为促进经济增长和发展做出贡献的大型基础设施项目提供融资的方式。

india may seek loans from other countries or international organizations to fund large infrastructure projects like the metro in bengaluru for several reasons, including:

1.insufficient domestic funds: india may not have sufficient domestic funds to finance large-scale infrastructure projects, such as the construction of a metro system.

2.attractive interest rates: loans from foreign countries or international organizations may offer more attractive interest rates compared to domestic loans, which may be subject to higher interest rates.

3.access to technology and expertise: by seeking loans from foreign countries or international organizations, india may also gain access to technology and expertise that can be helpful in building the metro system.

4.faster implementation: seeking loans from foreign countries or international organizations may help to expedite the implementation of the project by providing access to additional funds.

it is important to note that seeking loans from other countries or international organizations is a common practice for countries around the world, including developed nations. it is often seen as a way to finance large infrastructure projects that can contribute to economic growth and development.

印度可能会向其他国家或国际组织寻求贷款来资助像班加罗尔地铁这样的大型基础设施项目的原因包括:

1.国内资金不足:印度可能没有足够的国内资金来为大规模基础设施项目,如地铁系统的建设提供资金支持。

2.利率优势:与国内贷款相比,外国国家或国际组织的贷款可能提供更有吸引力的利率条件,其利率可能较低。

3.获取技术和专业知识:通过向外国国家或国际组织寻求贷款,印度还可以获得在建设地铁系统方面有帮助的技术和专业知识。

4.加快实施进度:从外国国家或国际组织寻求贷款可以通过提供额外资金来加速项目的实施进度。

需要注意的是,向其他国家或国际组织寻求贷款是世界各国(包括发达国家)的常见做法。这通常被视为一种为促进经济增长和发展做出贡献的大型基础设施项目提供融资的方式。

anand chandak

the loan of $474 million from japan to india is meant to support the construction of three lines (2a, 2b, and 6) in phase 2 of the namma metro in bengaluru. the loan has a repayment period of 30 years with a low interest rate of 1.15% per year, which is typical for large infrastructure projects.

as to why india took this loan ? countries often seek loans or aid from other nations or international institutions for major infrastructure ventures. these loans usually come with favorable terms, such as lower interest rates and longer repayment periods, compared to domestic financing options. india's decision to secure this loan is not an indication of its inability to afford the project but rather a strategic financial choice.

日本向印度提供的4.74亿美元贷款旨在支持班加罗尔namma metro第二阶段的三条线路(2a、2b和6)的建设。这笔贷款有30年的偿还期,并且利率非常低,每年为1.15%,这在大型基础设施项目中很常见。

至于为什么印度选择了这笔贷款?国家通常会向其他国家或国际机构寻求贷款或援助,用于重大基础设施项目。与国内融资选择相比,这些贷款通常具有较为优惠的条件,如较低的利率和较长的偿还期。印度决定获得这笔贷款并不意味着无力承担该项目,而是出于战略性的财务选择。

the loan of $474 million from japan to india is meant to support the construction of three lines (2a, 2b, and 6) in phase 2 of the namma metro in bengaluru. the loan has a repayment period of 30 years with a low interest rate of 1.15% per year, which is typical for large infrastructure projects.

as to why india took this loan ? countries often seek loans or aid from other nations or international institutions for major infrastructure ventures. these loans usually come with favorable terms, such as lower interest rates and longer repayment periods, compared to domestic financing options. india's decision to secure this loan is not an indication of its inability to afford the project but rather a strategic financial choice.

日本向印度提供的4.74亿美元贷款旨在支持班加罗尔namma metro第二阶段的三条线路(2a、2b和6)的建设。这笔贷款有30年的偿还期,并且利率非常低,每年为1.15%,这在大型基础设施项目中很常见。

至于为什么印度选择了这笔贷款?国家通常会向其他国家或国际机构寻求贷款或援助,用于重大基础设施项目。与国内融资选择相比,这些贷款通常具有较为优惠的条件,如较低的利率和较长的偿还期。印度决定获得这笔贷款并不意味着无力承担该项目,而是出于战略性的财务选择。

for japan and its banks, providing this loan brings loads of advantages:

1.paisa vasool: the interest earned from the loan ensures japanese banks have a solid income stream for a long, long time. talk about getting a good return on investment, boss!

2.strong jugaad: by helping india with this metro project, japan is forging a strong connection. this dosti can lead to more collaboration in trade, technology, defense, and whatnot.

3.business : with improved infrastructure in india, japanese companies can do business like never before. it's like adding extra masala to their success recipe.

4.japanese swag: being a part of this project allows japan to showcase its top-notch technologies and standards. they're setting a new trend. it's all about japanese swag!

so, while the loan supports india's metro system development, it's also a win-win situation for japan. they get paisa, dosti, business, and a chance to flaunt their swag!

对于日本及其银行来说,提供这笔贷款带来了许多优势:

1.明智的投资:贷款所赚取的利息确保了日本银行有一个长期稳定的收入来源。可以说是对投资的物超所值,老板!

2.强大的合作关系:通过帮助印度进行地铁项目,日本正在建立起强大的连接。这种友谊可能导致更多在贸易、技术、国防等方面的合作。

3.商业机会:随着印度基础设施的改善,日本企业可以开展前所未有的业务。这就像给他们的成功配方添加了额外的调料。

4.日本的炫耀:参与这个项目使日本能够展示其一流的技术和标准。他们正在树立一种新的潮流。这就是日本的炫耀!

因此,尽管这笔贷款支持了印度的地铁系统发展,对于日本来说也是双赢的局面。他们得到了利润、友谊、商业机会,并有机会展示他们的风格!

1.paisa vasool: the interest earned from the loan ensures japanese banks have a solid income stream for a long, long time. talk about getting a good return on investment, boss!

2.strong jugaad: by helping india with this metro project, japan is forging a strong connection. this dosti can lead to more collaboration in trade, technology, defense, and whatnot.

3.business : with improved infrastructure in india, japanese companies can do business like never before. it's like adding extra masala to their success recipe.

4.japanese swag: being a part of this project allows japan to showcase its top-notch technologies and standards. they're setting a new trend. it's all about japanese swag!

so, while the loan supports india's metro system development, it's also a win-win situation for japan. they get paisa, dosti, business, and a chance to flaunt their swag!

对于日本及其银行来说,提供这笔贷款带来了许多优势:

1.明智的投资:贷款所赚取的利息确保了日本银行有一个长期稳定的收入来源。可以说是对投资的物超所值,老板!

2.强大的合作关系:通过帮助印度进行地铁项目,日本正在建立起强大的连接。这种友谊可能导致更多在贸易、技术、国防等方面的合作。

3.商业机会:随着印度基础设施的改善,日本企业可以开展前所未有的业务。这就像给他们的成功配方添加了额外的调料。

4.日本的炫耀:参与这个项目使日本能够展示其一流的技术和标准。他们正在树立一种新的潮流。这就是日本的炫耀!

因此,尽管这笔贷款支持了印度的地铁系统发展,对于日本来说也是双赢的局面。他们得到了利润、友谊、商业机会,并有机会展示他们的风格!

ram vijay

the info by kanthaswamy balasubramaniam is absolutely right.

and few more points to add are japan need india has to be sustainable it's own for science and technology or along with japan as our common enenemy is china.

and japan don't want to invest their money in china which will make china stronger instead they can make india strong which will help japan in turn as both have disputes with china.

and the interest rate is also very less compared with world bank and imf.

kanthaswamy balasubramaniam的信息是完全正确的。还有几点要补充的是,日本需要印度在科学技术方面能够自给自足,或者与日本一起对抗我们共同的敌人中国。日本不希望把资金投资到中国,这样只会让中国变得更强大,相反他们可以帮助印度变得更强大,这将同时对日本有所帮助,因为两国都与中国存在争端。而且与世界银行和国际货币基金组织相比,日本提供的利率也非常低。

the info by kanthaswamy balasubramaniam is absolutely right.

and few more points to add are japan need india has to be sustainable it's own for science and technology or along with japan as our common enenemy is china.

and japan don't want to invest their money in china which will make china stronger instead they can make india strong which will help japan in turn as both have disputes with china.

and the interest rate is also very less compared with world bank and imf.

kanthaswamy balasubramaniam的信息是完全正确的。还有几点要补充的是,日本需要印度在科学技术方面能够自给自足,或者与日本一起对抗我们共同的敌人中国。日本不希望把资金投资到中国,这样只会让中国变得更强大,相反他们可以帮助印度变得更强大,这将同时对日本有所帮助,因为两国都与中国存在争端。而且与世界银行和国际货币基金组织相比,日本提供的利率也非常低。

alex gideon

it was japan who came to us for lending the project. the main reason for this is interest rate in japan is -0.10% and the interest rate for loan they to build metro is 0.1%. now you know why they were interested in offereing loan.

确实,正是日本向我们提供贷款。主要原因是,日本的利率为-0.10%,而用于建设地铁的贷款利率为0.1%。现在你知道他们为什么对提供贷款感兴趣了。

it was japan who came to us for lending the project. the main reason for this is interest rate in japan is -0.10% and the interest rate for loan they to build metro is 0.1%. now you know why they were interested in offereing loan.

确实,正是日本向我们提供贷款。主要原因是,日本的利率为-0.10%,而用于建设地铁的贷款利率为0.1%。现在你知道他们为什么对提供贷款感兴趣了。

s. anoop kumar

it’s basically a huge business deal. japan sells its metro project lixing one of the japanese banks to lend the money under most favourable terms of repayment & interest rate chargeable. some part of the interest charged by the bank is absorbed by the company that is selling the project. it’s a win win situation for all.

india gets a metro project with huge financing which meets the growing needs of infrastructure at most favourable terms.

japanese company is able to sell its product (read project) which makes a good profit out of the deal.

japanese bank(s) are able to lend their money at favourable rate of interest guaranteed both by the company & goi.

这基本上是一笔巨额的商业交易。日本出售其地铁项目,并将其中一家日本银行与最有利的还款条件和可收取的利率出借资金。银行收取的部分利息由销售该项目的公司吸收。这是一个双赢的局面。

印度以最有利的条件获得了一项巨额融资的地铁项目,以满足不断增长的基础设施需求。

日本公司能够出售其产品(即项目),从中获得良好的利润。

日本银行能够以有利的利率借出资金,该利率由公司和印度政府担保。

it’s basically a huge business deal. japan sells its metro project lixing one of the japanese banks to lend the money under most favourable terms of repayment & interest rate chargeable. some part of the interest charged by the bank is absorbed by the company that is selling the project. it’s a win win situation for all.

india gets a metro project with huge financing which meets the growing needs of infrastructure at most favourable terms.

japanese company is able to sell its product (read project) which makes a good profit out of the deal.

japanese bank(s) are able to lend their money at favourable rate of interest guaranteed both by the company & goi.

这基本上是一笔巨额的商业交易。日本出售其地铁项目,并将其中一家日本银行与最有利的还款条件和可收取的利率出借资金。银行收取的部分利息由销售该项目的公司吸收。这是一个双赢的局面。

印度以最有利的条件获得了一项巨额融资的地铁项目,以满足不断增长的基础设施需求。

日本公司能够出售其产品(即项目),从中获得良好的利润。

日本银行能够以有利的利率借出资金,该利率由公司和印度政府担保。

santhakumar v

one reason:if india uses the money from domestic sources, the interest rate could be around 10 percent. japan may be able to give loans at 1–2 percent interest. that is because of the lower cost of capital in japan.

一个原因:如果印度使用国内资金,利率可能会达到10%左右。日本可能能够以1-2%的利率提供贷款,这是因为日本的资金成本较低。

one reason:if india uses the money from domestic sources, the interest rate could be around 10 percent. japan may be able to give loans at 1–2 percent interest. that is because of the lower cost of capital in japan.

一个原因:如果印度使用国内资金,利率可能会达到10%左右。日本可能能够以1-2%的利率提供贷款,这是因为日本的资金成本较低。

prem saini

india needs huge investment for infrastructure development as the previous govts didn't do much in this direction.

印度需要大量的投资来发展基础设施,因为之前的政府在这方面没有做太多工作。

india needs huge investment for infrastructure development as the previous govts didn't do much in this direction.

印度需要大量的投资来发展基础设施,因为之前的政府在这方面没有做太多工作。

nisar ahmed

the principle factor in any trade deal - finance and economics. get your funding from the cheapest most economical source with the best and easiest payback terms and conditions. from the most favourable source.

在任何贸易协议中,最重要的因素是财务和经济。从最便宜、最经济的来源获得资金,并获得最有利且最容易返还的条件。从最有利的来源获取资金。

the principle factor in any trade deal - finance and economics. get your funding from the cheapest most economical source with the best and easiest payback terms and conditions. from the most favourable source.

在任何贸易协议中,最重要的因素是财务和经济。从最便宜、最经济的来源获得资金,并获得最有利且最容易返还的条件。从最有利的来源获取资金。

评论翻译

很赞 (1)

oh we have the money but don't know how to build the metro! we are buying the japanese technology.

also getting into debt is a good thing. if japan is willing to provide a loan which will be paid for by the users in due time and government of india as well as karnataka don't have to spend that money on metro, that money can be utilised for something better — like fixing roads every 2 months and cleaning drains every time they get clogged.

hence, if we are getting money nearly free, why hold up our money?

哦,我们有钱,但不知道如何建设地铁!我们正在购买日本的技术。 此外,负债是一件好事。如果日本愿意提供贷款,这些贷款将由用户和印度政府及卡纳塔克邦在适当的时间内偿还,那么政府就不必将这笔钱花在地铁上,这笔钱可以用于更好的事情——比如每两个月修路,每次下水道堵塞时清理。 因此,如果我们能够几乎免费获取资金,为什么要留住我们的钱?

there is one agreement the japan makes while giving loans that all the equipment will be imported from japan and the major part of profit is passed to japanese companies which keep balance in payment and keeps running the factories in japan .

believe it or not it is business and japanese know it the best .

在提供贷款时,日本有一个协议,即所有设备都将从日本进口,并且利润的大部分将流向日本公司,从而保持付款平衡并维持日本工厂的运作。 信不信由你,这就是生意,而日本人最懂这一点。

and indian government is giving loans or aid to other nations, and indian industrialists are investing in other countries.

印度政府正在向其他国家提供贷款或援助,而印度的工业家们也在其他国家投资。

原创翻译:龙腾网 http://www.ltaaa.cn 转载请注明出处

japanese population is at a stuck so japan money is not increasing so the want to invest in growing ecnomical countries

日本人口停滞不前,因此日本的资金不增加,所以他们希望在经济增长的国家进行投资。

japan has faced deflation over the years. better is if they lend to developing countries who buy their machinery, equipments and raw material which gives them trade gains. india is also happy as it can rotate its own money for other useful welfare projects and use japanese loans to improvise its infrastructure. there will be a time when japan will land into inflation ballpark and then they will stop funding developing nations. understand the scenario this way. you are given rs.100 as a loan at say just 0.5% to 1.5% for buying mangoes from the lender. he gets to sell his mangoes for rs.100 when it cost him rs.30–40 for complete harvest cycle and remains that for many years. you will have ended up paying it in a few years as your mangoes are going to be used toproduce jams, pickles, squash etc… your lender is happy until your lender has to spend more for the yield insofar he cannot make a margin selling it for rs.100. then you wont borrow and he wont lend. the story will end there.

日本多年来一直面临通货紧缩问题。更好的做法是他们向购买他们机械设备和原材料的发展中国家提供贷款,从中获得贸易收益。印度也很高兴,因为它可以将自己的资金用于其他有益的福利项目,并利用日本的贷款改善基础设施。但随着时间的推移,日本可能会陷入通货膨胀的困境,届时他们将停止对发展中国家的资金支持。可以这样理解这种情况。假设你以0.5%到1.5%的利率从贷款人那里获得100卢比的贷款,用于购买芒果。当芒果在收获周期花费30-40卢比时,贷款人可以以100卢比的价格出售芒果,并保持多年不变。在未来几年里,你将偿还贷款,因为你的芒果将被用来制作果酱、泡菜、果汁等。贷款人在能够以100卢比的价格销售芒果而不必花费更多成本的情况下,会感到满意。但一旦他的成本超过100卢比,他就无法获得利润,那么你就不会再借款,他也不会再贷款。故事就此结束。

banks in japan are having funds but that does not mean india has money to finance it's projects.

be realistic we don't have funds to build everything

日本的银行可能有资金,但这并不意味着印度有资金来为自己的项目提供融资。 让我们实事求是一点,我们没有足够的资金来建设一切。

…. not just because its flush with money. it is to buy carbon credits. its a stupid currency hypocrites of west have developed to ensure poor remain poor, while the countless atomic explosions of the past are the reasons we are facing global warming today.

……这不仅仅是因为他们有很多钱。这是为了购买碳减排配额。这是西方伪善者发展出来确保穷人保持贫困的愚蠢货币,而过去无数次的原子爆炸才是我们今天面临全球变暖的原因。

simple. it's an election year and bjp would like to use as much money as possible to dole out freebies to the voters.

很简单。这是选举年,人民党希望尽可能多地使用资金来向选民散发免费赠品。

that's a pure bhakt propaganda logic generated and propagated through whatsapp. japan requesting us to take loans….

这纯粹是支持者的宣传逻辑,通过whatsapp生成和传播的。日本要求我们借贷...

railway loans mean you buy japanese rail cars. for the next 30 years, you buy parts at market prices.

铁路贷款意味着你购买日本的铁路车辆。在接下来的30多年里,你以市场价格购买零部件。